Behind the Numbers: How a Virtual Assistant for an Accounting Firm Turned Inbox Chaos into Clear Processes

If you run an accounting or bookkeeping practice, you’re no stranger to the constant juggling of client needs, deadlines, and back-end admin. The problem isn’t the work itself. It’s everything around it. This story shows what happens when a Virtual Assistant for an accounting firm is scoped properly and supported with the right structure.

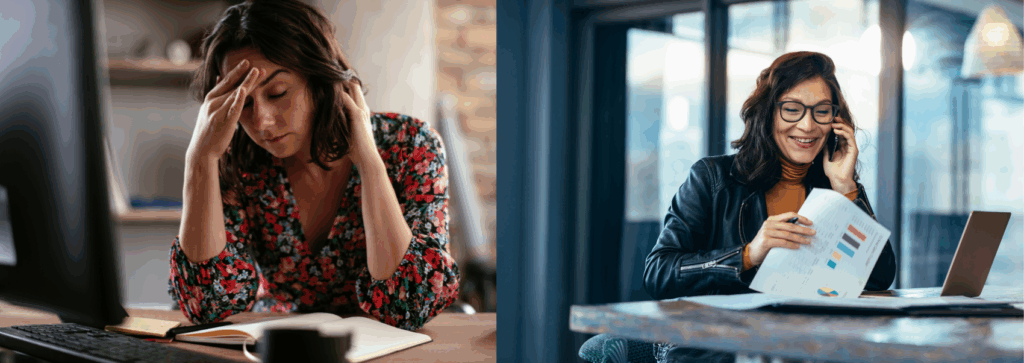

Endless emails. Admin. Chasing documents. Writing the same instructions again and again so your team can follow your way of doing things.

That was Mandy’s world.

After six years in business and a rebrand to focus on the work she actually wanted to do, Mandy’s accounting firm was thriving. But behind the scenes, her time was vanishing into inbox management, admin, and “things in my head that no one else can see,” as Mandy put it.

So she brought in a skilled Filipino Virtual Assistant through Empowering Virtual Solution.

Here’s how we shaped that role so it actually supported her accounting practice, protected her time, and created clearer processes, not just added another person to manage.

The Real Challenge: It’s Not the BAS, It’s the Busywork

Mandy wasn’t looking for more clients. Most of her growth came from referrals and long-term relationships. She wasn’t chasing marketing, funnels, or online visibility.

What was keeping her stuck was not the accounting work itself, but the admin surrounding it.

She was dealing with a busy personal inbox alongside an admin inbox. Admin tasks stayed with her because it felt faster to just do them herself. Onboarding relied heavily on memory. Client processes lived in her head. Her remote team needed clearer task flow.

This is not unusual. Research shows that knowledge workers lose up to 28 percent of their week to emails alone. A 2025 Talker Research and HP survey also revealed that 51 percent of the workday disappears into repetitive, low-value tasks like email, data entry, and document chasing. Most workers link this directly to burnout.

For an accounting or BAS practice, that is a serious issue. You carry compliance risk, deadlines, and client expectations, yet half your day can vanish into admin that does not require your qualifications.

Mandy’s goal was simple.

“Get the admin side managed, and get everything out of my head and documented so the business isn’t so dependent on me.”

That is where the Virtual Assistant for an accounting firm came in.

From Part-Time Backup to Full-Time Support

Mandy hired her Filipino Virtual Assistant in October 2024. She started part-time and moved to full-time by December once the value became undeniable.

Her team was already remote, so bringing in a Virtual Assistant for an accounting firm was about finding the right person, the right skillset, and the right structure.

Through our task scoping process, we built a role that tackled exactly what was slowing her down.

What a Virtual Assistant for an Accounting Firm Actually Does

This is the real behind-the-scenes work that keeps an accounting practice running smoothly.

The Virtual Assistant manages calendar coordination across Outlook and Google Calendar, schedules meetings, and sets reminders so nothing is missed.

They handle accounts and access setup, including admin and owner email accounts, Trello and ClickUp accounts, Google Drive permissions, and secure password storage.

They organise Google Drive and Dropbox, ensuring documents are filed correctly and folder structures stay clean and usable.

They manage ClickUp task updates by organising tasks, due dates, and recurring schedules, with reminders built in.

Inbox management is a major focus. The Virtual Assistant manages both Mandy’s personal inbox and the admin inbox, sorts emails into client folders, categorises messages for visibility, follows up on missing BAS documents, forwards information to the team, and emails clients directly when appropriate.

They also create and update client forms, maintain task forms, prepare client agreements and POI forms, and support basic bookkeeping tasks such as invoicing, reporting, updating files, reconciling transactions, and completing QBO certification work.

This work is not flashy, but it is what gives Mandy her time back.

Email and Calendar Management: Protecting the Accountant’s Brain

Before hiring a Virtual Assistant for an accounting firm, Mandy handled everything herself. Every email. Every document. Every follow-up. Every appointment.

Now her Virtual Assistant handles inbox triage, client follow-ups, categorisation, and scheduling. That removes the daily mental load and gives Mandy hours back each week.

Onboarding and Bookkeeping Support

Mandy still owns the technical accounting work. That has not changed. What has changed is who handles the repeatable admin tasks.

The Virtual Assistant prepares engagement documents, files signed agreements, creates invoices, reconciles transactions, and keeps client files updated.

For Australian accounting firms, these tasks are ideal for a Virtual Assistant for an accounting firm. They are structured, predictable, and easy to systemise, but incredibly time-consuming for qualified accountants.

Building the Procedures She Never Had Time to Build

The biggest transformation was not inbox management. It was documentation.

Mandy wanted clear instructions per client, documented daily, monthly, and quarterly workflows, a reliable ClickUp or Trello system, and reduced dependency on her memory.

The Virtual Assistant’s role expanded to managing the admin board, keeping procedures up to date, turning verbal instructions into written SOPs, and improving processes as the business evolved.

For accounting firms, this is not just admin. It is risk management and business continuity.

Why a Supervised Filipino VA Made the Difference

Two things made this work.

First was the match. Mandy’s Virtual Assistant for an accounting firm was tech-savvy, detail-oriented, comfortable across multiple systems, process-driven, and calm under pressure.

Second was ongoing supervision. The VA is supported by an EVS Supervisor who reviews daily reports, helps prioritise tasks, supports new challenges, and ensures nothing gets missed.

Mandy is not managing the VA alone. She has a whole team backing her.

Key Takeaways for Accounting and BAS Firm Owners

If you see yourself in Mandy’s journey, there are a few key lessons worth taking.

Your inbox should not control your day. Admin and basic bookkeeping can be safely delegated. A Virtual Assistant for an accounting firm can build SOPs one task at a time. Part-time support can evolve into full-time once the value is clear. Offshore support works exceptionally well for accounting workflows.

Mandy did not hire a Virtual Assistant to scale aggressively. She hired one to make her firm smoother, documented, and less dependent on her.

And it worked.

If you are a 7-figure financial services or accounting business owner who is tired of living in your inbox and in your head, it might be time to ask a better question than “Do I need another local hire?”

You might just need the right Virtual Assistant for an accounting firm, and that is exactly where EVS can support you.

If you would like to explore what this could look like for your firm, reach out to the team at Empowering Virtual Solution or book a call and see if it is the right fit.

Disclaimer

To protect client privacy, the name used in this case study is a code name. Specific identifying details have been adjusted where appropriate, while the outcomes, processes, and results described remain accurate and representative of the real client experience.